Checking your access...

Check Your Inbox

A verification email has been sent. Follow the link in your inbox to complete signup.

Didn't see the email? Check your junk/spam folder or try resending.

Access Granted

Your page will refresh

The Robo Report

Get free access to the industry's most comprehensive analysis and see who topped the charts.

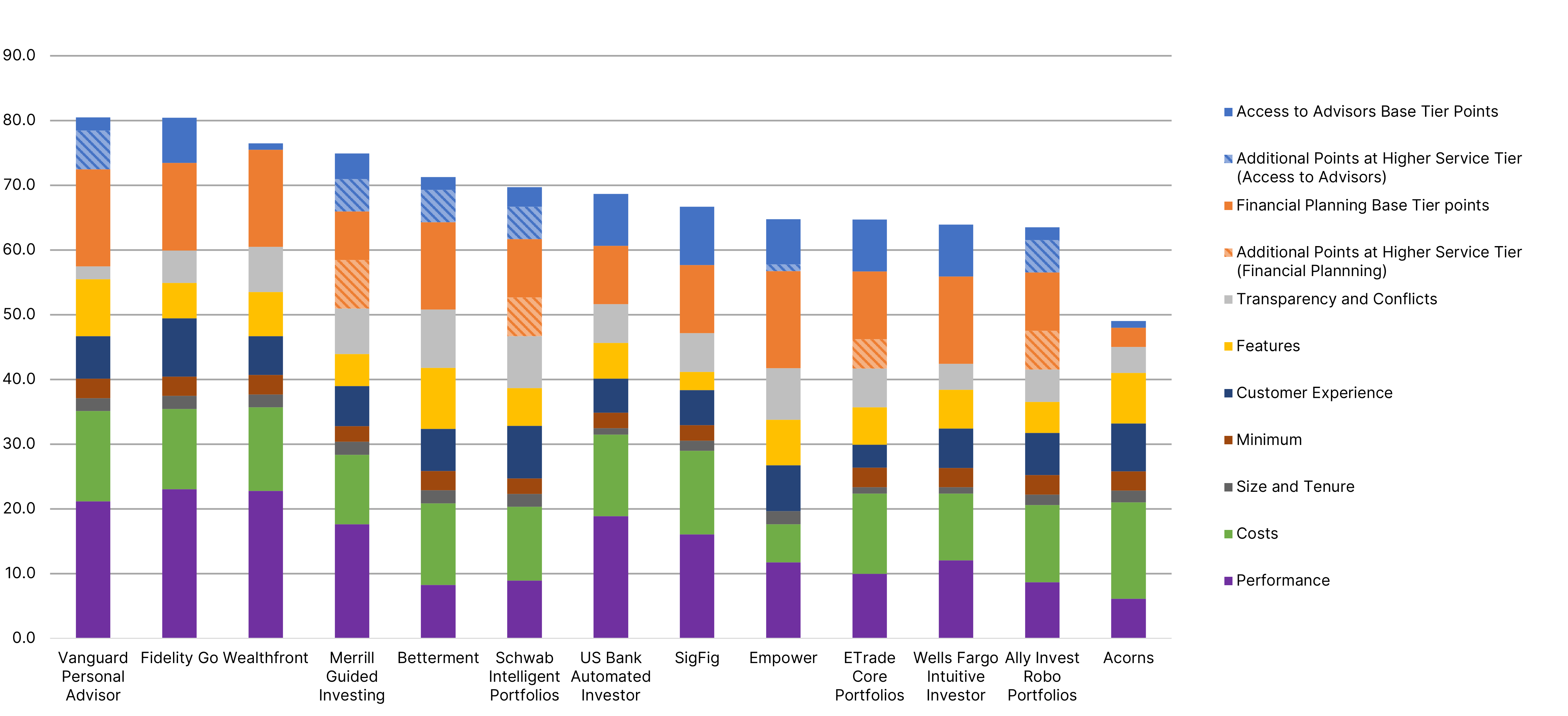

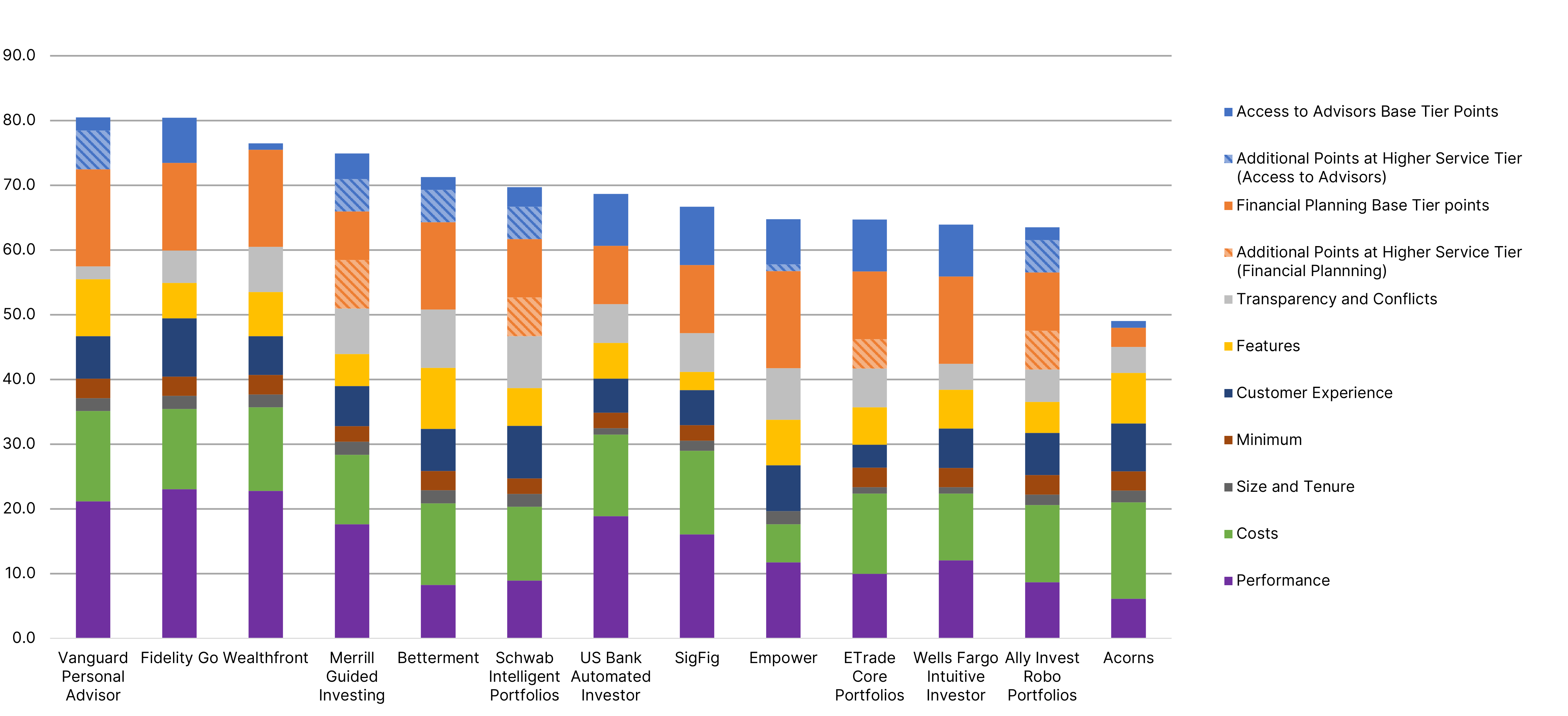

Are you curious about which robo advisors are delivering the best performance? We've analyzed over 45 metrics across the industry to bring you the most detailed rankings and insights.

Enter your email below to get free access to the report.

Sign Up For Your Free Robo Report

The Robo Ranking

Highlights

- Vanguard Personal Advisor wins Best Overall Robo, offering stellar performance, low fees, a range of investment options, and robust features.

- The winners of Best Robo for Digital Financial Planning, Empower and Wealthfront, serve as an example of simple yet effective online planning.

- Fidelity Go won Best Robo for First-Time Investors due to its low fees, accessible digital platform, and live operational support.

- Wealthfront wins Best Robo for Performance at a Low Cost, leveraging a dedicated energy holding, competitive fees, and robust returns for budget-conscious investors.

Performance scores are based on Sharpe ratios using 5-year returns and standard deviations as of 12/31/2024.

Best Overall Robo Advisor

- Winner: Vanguard Personal Advisor

- Runner up: Fidelity Go

Vanguard Personal Advisor is our winner for Best Overall Robo in this year’s Robo Ranking Winter Edition. Vanguard provides investors with two main tiers: Vanguard Digital Advisor, a purely digital solution requiring just $100 to start, and Vanguard Personal Advisor, a hybrid offering that includes live advisor support and requires a $50,000 minimum. Both tiers emphasize Vanguard’s well-known commitment to low fees, with Vanguard Digital Advisor capping its total at 0.20% and Vanguard Personal Advisor charging a competitive 0.30% annually. While the personal advisor service comes with a higher minimum, it gives investors access to comprehensive planning with human advisors. The platform excels in financial planning and offers strong features, scoring high in our assessment thanks to robust goal-setting tools and an intuitive interface.

Performance was another standout factor for Vanguard, with Vanguard Personal Advisor scoring near the top of our tracked universe. Its portfolios typically maintain a balanced target allocation—around 60% equities and 40% fixed income—and it allocates its fixed income segment to municipal bonds. This emphasis on municipal bonds enhances after-tax returns for those with taxable portfolios, and boosted performance as municipals have outperformed corporates recently. Combined with Vanguard’s legacy of low-cost index investing, investors benefit from both cost efficiency and prudent asset allocation. Overall, Vanguard Personal Advisor is an excellent choice for those looking to blend digital convenience with human guidance, offering a trusted brand, solid performance, and a thoughtful, cost-effective approach to portfolio construction.

Fidelity Go is our runner-up for Best Overall Robo in this year’s Robo Ranking Winter Edition. It stands out for its competitive fees and robust features. The platform charges no management fee for balances below $25,000 and imposes a 0.35% fee only once the balance reaches $25,000 or more. There’s no minimum balance required at the base level, but a $25,000 balance is needed to access live advisors. This cost efficiency makes it an attractive option for investors seeking a low-cost robo advisor. Fidelity Go also offers access to live operational support and licensed advisors (series 66 or 65), providing significant advantages to users. While Certified Financial Planners (CFPs) and dedicated advisors are not available at the base tier, the platform excels in financial planning, offering tools to build single and multi-goal financial plans, model various "what-if" scenarios, and determine retirement spending needs. The inclusion of Social Security estimates and the ability to incorporate pension income further enhance its comprehensive approach to retirement planning. Additionally, Fidelity Go delivers a superior customer experience with educational materials, a fully integrated digital advice portal, a mobile app, chat support, and account aggregation for a holistic financial picture.

Fidelity Go achieved exceptional performance scores, making it one of the top performers in our tracked universe. The platform's significant allocation to municipal bonds and its positioning with a bias towards large-caps have contributed to its strong returns relative to benchmarks and on a risk-adjusted basis. The lack of a cash allocation ensures that the portfolio is fully invested, maximizing potential returns. Over the trailing 5-year period, Fidelity Go’s portfolio managed to outperform its normalized benchmark by 0.67%, showcasing its effective investment strategy. Despite the challenges faced by equities and fixed income in 2022, Fidelity Go’s strategic asset allocation mitigated the effects of the broader market sell-off, resulting in solid performance. Overall, Fidelity Go is an excellent choice for investors, offering a blend of low fees, robust financial planning tools, strong performance, and a user-friendly experience.

Best Robo for Performance at a Low Cost

- Winner: Fidelity Go

- Runner-up: Wealthfront

The Best Robo for Performance at a Low Cost category is designed for investors seeking the strong returns. We evaluate performance based on total portfolio returns compared to a Normalized Benchmark and each portfolio’s Sharpe Ratio. For the five-year period ending December 31, 2024, Fidelity Go and Wealthfront emerged as top performers, with Fidelity Go taking the top spot. This period included the latter half of the post-Covid recovery, a phase of heightened inflation, ongoing geopolitical tensions, and a series of rapid interest rate hikes.

Fidelity Go posted excellent results over the five-year period. Its equity positioning tends to be neutral when it comes to growth versus value; however, the platform does lean more heavily toward large-cap stocks—an allocation of roughly 77% versus the industry average of about 69% in our tracked universe. This tilt paid off handsomely, as large-caps have been leading equities over the last five years. On the fixed income side, Fidelity Go devotes its entire bond allocation to municipal bonds, one of the stronger-performing fixed income segments of the past few years.

Wealthfront benefited significantly from its dedicated energy holding, which proved advantageous during the sustained inflationary environment and disruptions in global energy markets following the Russian invasion of Ukraine. The energy sector delivered impressive returns through 2022, far outpacing the S&P 500 and aligning with the broader trend of value stocks outperforming growth stocks at the time. However, growth stocks have rallied strongly since then, with the Russell 3000 Growth Index outperforming the Russell 3000 Value Index by an average of 9.7% annually over the trailing five years ending December 31, 2024. Beyond energy, Wealthfront also holds municipal bonds and TIPS, which have delivered strong returns relative to other fixed income securities.

Best Robo for First-Time Investors

- Winner: Fidelity Go

- Runner-up: Wealthfront

Fidelity Go is the winner in the Best Robo for First Time Investors category due to a combination of low costs, an accessible digital platform, and impressive long-term returns. Fidelity Go users will benefit from low fees through a combination of no-cost Fidelity Flex funds, as well as no management fee on the first $25,000 invested, making it especially attractive for investors with smaller amounts of money to start with. This combined with strong long-term performance due, in part, to its bias towards large-cap equities makes Fidelity Go a great option for first-time investors.

Wealthfront takes the runner-up spot. Although it requires a $500 minimum, Wealthfront’s transparent 0.25% fee is competitive, and it offers one of the most advanced digital platforms in the robo space. The service’s intuitive planning features—particularly its free, in-depth planning tool—let users model different life events, plan for retirement, and even integrate external accounts for a holistic financial overview. Wealthfront’s streamlined, tech-forward approach, paired with automated portfolio management (including tax-loss harvesting for taxable accounts), makes it a strong option for beginners comfortable with a fully digital experience.

Best Robo for Digital Financial Planning

- Winner: Empower

- Runner-up: Wealthfront

The most significant effect that robo advisors have exerted on the financial advice industry is the democratization of expertly managed portfolios. Robo advisors have not just facilitated widespread access to advised accounts, but they have also enabled high-caliber financial planning to become available to anyone equipped with an internet connection and the readiness to invest the time into building a plan.

The winners of this category offer the best digital planners among the robos we track. The two winners of this category, Empower (formerly known as Personal Capital) and Wealthfront, offer their digital plans to anyone without the need to open an account. These platforms offer the ability to build a holistic financial plan by combining multiple goals into a single plan, while also aggregating outside accounts so investors can get a view of their full financial picture. They make planning for the future easy by enabling users to model future life events, such as Social Security and other retirement income, as well as life events such as windfalls and other custom inputs, all while presenting it in an easy-to-use manner and offering it in the standard, free versions of their services.

Empower remains at the top of our list when it comes to financial planning tools. The robo enables users to plan for retirement, home purchase, education, and general saving among other goals with a plethora of in-depth tools. The retirement fee analyzer looks at your portfolio’s holdings and estimates what portion of your portfolio will be lost to expense ratios, while the planner allows you to set up multiple spending goals along with projected future income and calculates a probability of success in the stated goals. The planner also allows you to map out a plan to pay down debt alongside your current savings, as well as an emergency fund. It will aggregate outside accounts and present you with a consolidated display of your monthly cash flows, overall net worth, and other views of your finances in a single dashboard. The robo offers a feature called Investment Checkup that explains how and why you should be rebalancing your portfolio, while taking into account your age, risk tolerance, and portfolio composition. Through its ability to aggregate outside accounts, it is also able to analyze positions held elsewhere. Overall, Empower continues to be our top pick for robos related to financial planning due to its in-depth planning tools offerings, including a multi-goal financial plan and the ability to customize inputs specific to the investor.

Wealthfront’s digital planning tools are representative of their digital-first philosophy, eliminating the need for human advisors and the higher fees attached to them. The planning tool allows for goals specific to retirement, education, home buying, and travel, with the home buying module utilizing Redfin data. While it is a little more complex than Empower’s, the planning tool comes with a high degree of customization like projecting retirement income such as Social Security, windfalls, real estate, and other details, allowing for users to build out complex plans. It also utilizes a set of automated or semi-automated features that enable users to invest excess cash held in their bank accounts. This allows for users to integrate their spending and saving habits with their long-term goals. Wealthfront’s planner continues to be a premier example of innovation among robo advisors.

Best Robo for Complex Financial Planning

- Winner: Vanguard

- Runner-up: Empower

While some digital planning tools do a good job modeling complex situations, those with complex planning needs may still benefit from access to live advisors alongside robo planning, or a hybrid model. Vanguard wins the title for Best Robo for Complex Financial Planning. Their hybrid advice model allows access to a team of live financial advisors at a minimum investment of $50,000 for just 0.30% in management fees. For a $500,000 investment, investors get access to a dedicated adviser, available for the same low fee. This allows investors to model multiple financial goals and get a comprehensive view of their assets at a price point far below the management fees typically charged by traditional financial advisors.

Empower, the runner-up for Complex Financial Planning combines access to a live planner with one of the best digital planning platforms on the market. Empower has a high minimum investment at $100,000 and a high management fee at 0.89% but offers some stand out features. Aside from its planning tools, Empower offers investment options such as an SRI portfolio, and direct indexing, and for those with more than $5,000,000 on the platform, alternative investments like private equity are also available. Empower also offers a feature called Smart Withdrawal which simplifies the process of determining where to withdraw retirement spending funds, and how to do so in a tax efficient manner. This feature can assist with more complex decisions, like whether tax gain harvesting should be considered, or if a Roth conversion may be beneficial. These features combine to make Empower one of the best robo options for complex financial planning, even with its higher fees.

Highlights

- Vanguard Personal Advisor wins Best Overall Robo, offering stellar performance, low fees, a range of investment options, and robust features.

- The winners of Best Robo for Digital Financial Planning, Empower and Wealthfront, serve as an example of simple yet effective online planning.

- Fidelity Go won Best Robo for First-Time Investors due to its low fees, accessible digital platform, and live operational support.

- Wealthfront wins Best Robo for Performance at a Low Cost, leveraging a dedicated energy holding, competitive fees, and robust returns for budget-conscious investors.

Performance scores are based on Sharpe ratios using 5-year returns and standard deviations as of 12/31/2024.

Best Overall Robo Advisor

- Winner: Vanguard Personal Advisor

- Runner up: Fidelity Go

Vanguard Personal Advisor is our winner for Best Overall Robo in this year’s Robo Ranking Winter Edition. Vanguard provides investors with two main tiers: Vanguard Digital Advisor, a purely digital solution requiring just $100 to start, and Vanguard Personal Advisor, a hybrid offering that includes live advisor support and requires a $50,000 minimum. Both tiers emphasize Vanguard’s well-known commitment to low fees, with Vanguard Digital Advisor capping its total at 0.20% and Vanguard Personal Advisor charging a competitive 0.30% annually. While the personal advisor service comes with a higher minimum, it gives investors access to comprehensive planning with human advisors. The platform excels in financial planning and offers strong features, scoring high in our assessment thanks to robust goal-setting tools and an intuitive interface.

Performance was another standout factor for Vanguard, with Vanguard Personal Advisor scoring near the top of our tracked universe. Its portfolios typically maintain a balanced target allocation—around 60% equities and 40% fixed income—and it allocates its fixed income segment to municipal bonds. This emphasis on municipal bonds enhances after-tax returns for those with taxable portfolios, and boosted performance as municipals have outperformed corporates recently. Combined with Vanguard’s legacy of low-cost index investing, investors benefit from both cost efficiency and prudent asset allocation. Overall, Vanguard Personal Advisor is an excellent choice for those looking to blend digital convenience with human guidance, offering a trusted brand, solid performance, and a thoughtful, cost-effective approach to portfolio construction.

Fidelity Go is our runner-up for Best Overall Robo in this year’s Robo Ranking Winter Edition. It stands out for its competitive fees and robust features. The platform charges no management fee for balances below $25,000 and imposes a 0.35% fee only once the balance reaches $25,000 or more. There’s no minimum balance required at the base level, but a $25,000 balance is needed to access live advisors. This cost efficiency makes it an attractive option for investors seeking a low-cost robo advisor. Fidelity Go also offers access to live operational support and licensed advisors (series 66 or 65), providing significant advantages to users. While Certified Financial Planners (CFPs) and dedicated advisors are not available at the base tier, the platform excels in financial planning, offering tools to build single and multi-goal financial plans, model various "what-if" scenarios, and determine retirement spending needs. The inclusion of Social Security estimates and the ability to incorporate pension income further enhance its comprehensive approach to retirement planning. Additionally, Fidelity Go delivers a superior customer experience with educational materials, a fully integrated digital advice portal, a mobile app, chat support, and account aggregation for a holistic financial picture.

Fidelity Go achieved exceptional performance scores, making it one of the top performers in our tracked universe. The platform's significant allocation to municipal bonds and its positioning with a bias towards large-caps have contributed to its strong returns relative to benchmarks and on a risk-adjusted basis. The lack of a cash allocation ensures that the portfolio is fully invested, maximizing potential returns. Over the trailing 5-year period, Fidelity Go’s portfolio managed to outperform its normalized benchmark by 0.67%, showcasing its effective investment strategy. Despite the challenges faced by equities and fixed income in 2022, Fidelity Go’s strategic asset allocation mitigated the effects of the broader market sell-off, resulting in solid performance. Overall, Fidelity Go is an excellent choice for investors, offering a blend of low fees, robust financial planning tools, strong performance, and a user-friendly experience.

Best Robo for Performance at a Low Cost

- Winner: Fidelity Go

- Runner-up: Wealthfront

The Best Robo for Performance at a Low Cost category is designed for investors seeking the strong returns. We evaluate performance based on total portfolio returns compared to a Normalized Benchmark and each portfolio’s Sharpe Ratio. For the five-year period ending December 31, 2024, Fidelity Go and Wealthfront emerged as top performers, with Fidelity Go taking the top spot. This period included the latter half of the post-Covid recovery, a phase of heightened inflation, ongoing geopolitical tensions, and a series of rapid interest rate hikes.

Fidelity Go posted excellent results over the five-year period. Its equity positioning tends to be neutral when it comes to growth versus value; however, the platform does lean more heavily toward large-cap stocks—an allocation of roughly 77% versus the industry average of about 69% in our tracked universe. This tilt paid off handsomely, as large-caps have been leading equities over the last five years. On the fixed income side, Fidelity Go devotes its entire bond allocation to municipal bonds, one of the stronger-performing fixed income segments of the past few years.

Wealthfront benefited significantly from its dedicated energy holding, which proved advantageous during the sustained inflationary environment and disruptions in global energy markets following the Russian invasion of Ukraine. The energy sector delivered impressive returns through 2022, far outpacing the S&P 500 and aligning with the broader trend of value stocks outperforming growth stocks at the time. However, growth stocks have rallied strongly since then, with the Russell 3000 Growth Index outperforming the Russell 3000 Value Index by an average of 9.7% annually over the trailing five years ending December 31, 2024. Beyond energy, Wealthfront also holds municipal bonds and TIPS, which have delivered strong returns relative to other fixed income securities.

Best Robo for First-Time Investors

- Winner: Fidelity Go

- Runner-up: Wealthfront

Fidelity Go is the winner in the Best Robo for First Time Investors category due to a combination of low costs, an accessible digital platform, and impressive long-term returns. Fidelity Go users will benefit from low fees through a combination of no-cost Fidelity Flex funds, as well as no management fee on the first $25,000 invested, making it especially attractive for investors with smaller amounts of money to start with. This combined with strong long-term performance due, in part, to its bias towards large-cap equities makes Fidelity Go a great option for first-time investors.

Wealthfront takes the runner-up spot. Although it requires a $500 minimum, Wealthfront’s transparent 0.25% fee is competitive, and it offers one of the most advanced digital platforms in the robo space. The service’s intuitive planning features—particularly its free, in-depth planning tool—let users model different life events, plan for retirement, and even integrate external accounts for a holistic financial overview. Wealthfront’s streamlined, tech-forward approach, paired with automated portfolio management (including tax-loss harvesting for taxable accounts), makes it a strong option for beginners comfortable with a fully digital experience.

Best Robo for Digital Financial Planning

- Winner: Empower

- Runner-up: Wealthfront

The most significant effect that robo advisors have exerted on the financial advice industry is the democratization of expertly managed portfolios. Robo advisors have not just facilitated widespread access to advised accounts, but they have also enabled high-caliber financial planning to become available to anyone equipped with an internet connection and the readiness to invest the time into building a plan.

The winners of this category offer the best digital planners among the robos we track. The two winners of this category, Empower (formerly known as Personal Capital) and Wealthfront, offer their digital plans to anyone without the need to open an account. These platforms offer the ability to build a holistic financial plan by combining multiple goals into a single plan, while also aggregating outside accounts so investors can get a view of their full financial picture. They make planning for the future easy by enabling users to model future life events, such as Social Security and other retirement income, as well as life events such as windfalls and other custom inputs, all while presenting it in an easy-to-use manner and offering it in the standard, free versions of their services.

Empower remains at the top of our list when it comes to financial planning tools. The robo enables users to plan for retirement, home purchase, education, and general saving among other goals with a plethora of in-depth tools. The retirement fee analyzer looks at your portfolio’s holdings and estimates what portion of your portfolio will be lost to expense ratios, while the planner allows you to set up multiple spending goals along with projected future income and calculates a probability of success in the stated goals. The planner also allows you to map out a plan to pay down debt alongside your current savings, as well as an emergency fund. It will aggregate outside accounts and present you with a consolidated display of your monthly cash flows, overall net worth, and other views of your finances in a single dashboard. The robo offers a feature called Investment Checkup that explains how and why you should be rebalancing your portfolio, while taking into account your age, risk tolerance, and portfolio composition. Through its ability to aggregate outside accounts, it is also able to analyze positions held elsewhere. Overall, Empower continues to be our top pick for robos related to financial planning due to its in-depth planning tools offerings, including a multi-goal financial plan and the ability to customize inputs specific to the investor.

Wealthfront’s digital planning tools are representative of their digital-first philosophy, eliminating the need for human advisors and the higher fees attached to them. The planning tool allows for goals specific to retirement, education, home buying, and travel, with the home buying module utilizing Redfin data. While it is a little more complex than Empower’s, the planning tool comes with a high degree of customization like projecting retirement income such as Social Security, windfalls, real estate, and other details, allowing for users to build out complex plans. It also utilizes a set of automated or semi-automated features that enable users to invest excess cash held in their bank accounts. This allows for users to integrate their spending and saving habits with their long-term goals. Wealthfront’s planner continues to be a premier example of innovation among robo advisors.

Best Robo for Complex Financial Planning

- Winner: Vanguard

- Runner-up: Empower

While some digital planning tools do a good job modeling complex situations, those with complex planning needs may still benefit from access to live advisors alongside robo planning, or a hybrid model. Vanguard wins the title for Best Robo for Complex Financial Planning. Their hybrid advice model allows access to a team of live financial advisors at a minimum investment of $50,000 for just 0.30% in management fees. For a $500,000 investment, investors get access to a dedicated adviser, available for the same low fee. This allows investors to model multiple financial goals and get a comprehensive view of their assets at a price point far below the management fees typically charged by traditional financial advisors.

Empower, the runner-up for Complex Financial Planning combines access to a live planner with one of the best digital planning platforms on the market. Empower has a high minimum investment at $100,000 and a high management fee at 0.89% but offers some stand out features. Aside from its planning tools, Empower offers investment options such as an SRI portfolio, and direct indexing, and for those with more than $5,000,000 on the platform, alternative investments like private equity are also available. Empower also offers a feature called Smart Withdrawal which simplifies the process of determining where to withdraw retirement spending funds, and how to do so in a tax efficient manner. This feature can assist with more complex decisions, like whether tax gain harvesting should be considered, or if a Roth conversion may be beneficial. These features combine to make Empower one of the best robo options for complex financial planning, even with its higher fees.

More From This Quarter

Performance Commentary

Highlights Over the past year, SoFi, TD Automated Investing, and Betterment Climate Impact led returns by emphasizing large-cap, domestic, and growth equities. SoFi distinguished itself with a 35% growth allocation, while Betterment Climate Impact’s 82% large-cap tilt outperformed small-caps’ modest 11.53% gain. Domestic large-cap stocks and municipal bonds propelled Wealthfront, Fidelity Go, and SoFi to […]

Explore Robo Report Data

Access comprehensive historical performance, risk/return statistics, and more.

Learn More About Robo Investing

How to Pick a Robo Advisor

Discover how to select the best robo-advisor for your unique financial goals.

Robo vs. Traditional Advisors

Compare the benefits and drawbacks of robo-advisors versus traditional human advisors.

What is a Robo Advisor?

Learn the basics of robo-advisors and how they manage your investments using technology.

Disclosures

In previous reports, the initial target asset allocation was calculated as the asset allocation at the end of the first month after the account was opened. In the Q3 2018 report, we adjusted our method to calculate the initial target asset allocation as of the end of the trading day after all initial trades were placed in the accounts. This adjustment has caused some portfolio’s initial target allocation to be updated from previous reports. These updates did not change any initial target allocations of equity, fixed income, cash, or other by more than 1%.

Prior to Q3 2018, due to technological limitations of our portfolio management system, some accounts which contained fractional shares had misstated the quantity of shares when transactions quantities were smaller than 1/1000th of a share in a position as a result of purchases, sales, or dividend reinvestments. This had a marginal effect on the historical performance of the accounts. The rounding of position quantities caused by this limitation has been resolved, and quantities have been adjusted to reflect the full position to the 1/1,000,000th of a share as of the end of Q3 2018. Therefore, this rounding of fractional shares will not be necessary in the future.

At certain custodians, a combination of the custodian providing us a limited number of digits on fractional share and fractional cent transactions rounding errors are introduced into our tracking. At quarter-end starting 3/31/2020, we implemented a process to enter small transactions to eliminate any rounding errors that have built up to more than a full cent. These transactions are small and do not have an appreciable effect on performance. Sharpe ratios and Standard Deviation calculations are calculated with the assumption of 252 trading days in a year.

This report represents Condor Capital Wealth Management’s research, analysis and opinion only; the period tested was short in duration and may not provide a meaningful analysis; and, there can be no assurance that the performance trend demonstrated by Robos vs indices during the short period will continue. A copy of Condor’s Disclosure Brochure is available at www.condorcapital.com. Condor Capital holds a position in Schwab in one of the strategies used in many of their discretionary accounts. As of 12/31/2024, the total size of the position was 64,818 shares of Schwab common stock. As of 12/31/2024, accounts discretionarily managed by Condor Capital Management held bonds issued by the following companies: Morgan Stanley, Bank of America, Wells Fargo, E*Trade, Citi Group, Citizens Financial Group, Ally Financial, Charles Schwab, Fidelity, and TD Bank.

Notice

We use cookies to enhance your browsing experience. By continuing, you consent to our use of cookies.