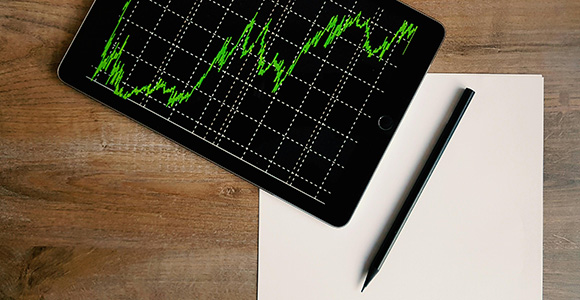

Large Cap Growth and Inflation Data

The S&P 500 Index rose by 4.28% in the second quarter of 2024, finishing the period just shy of all-time highs. The so-called Magnificent Seven stocks once again outperformed the broader market, though the performance of those seven individual stocks did have more dispersion than in prior quarters. The artificial intelligence theme continued to fuel large cap growth stocks through the second quarter. Small and mid-cap indices declined in the quarter as more rate-sensitive sectors of the economy began to feel the effects of the Federal Reserve’s prolonged campaign of higher interest rates.

Economic activity remained robust, and predictions for U.S. GDP growth and consumer spending exceeded initial forecasts. U.S. inflation data was mixed though the three months, eventually showing signs of falling to close out June 2024. Although the Federal Reserve is still forecasting more accommodative monetary policy by the end of 2024, persistent inflation has led to some questions over the pace and timing of rate cuts. The Fed is monitoring stronger-than-expected economic growth and job market resilience as well. As a result, market expectations have shifted over the course of 2024 from up to six rate cuts this year to just one or two.

International and Fixed Income Markets

International equities were mixed in the second quarter. The MSCI EAFE Index declined 0.20% in the quarter, while the MSCI Emerging Markets Index returned 5.03%. China’s economic woes showed signs of improvement, while the rally in Japanese equities stalled in the second quarter. The Topix lagged U.S. equities, gaining 1.69%. The dollar rose moderately in the quarter, and its elevated levels continued to weigh on some foreign currencies.

In fixed-income markets, the second quarter remained a somewhat difficult period as rate cuts continue to be delayed. While lower rates would boost bond prices due to the inverse relationship between price and yield if the Fed were to cut rates, investors are coming to grips with the idea that the central bank’s fight against inflation is not quite over yet. As a result, the Bloomberg U.S. Aggregate Bond Index posted a slightly negative return in the period and yields rose once again. The longer end of the yield curve moved up for the second quarter in a row, with the 10-year rising almost 20 basis points to 4.39%. High yield credit did not fare any better than investment grade after recent periods of outperformance.

Future Outlook: Inflation, Elections, and AI

Looking forward, inflation and interest rates appear likely to continue to drive the narrative for markets. In a similar story to previous quarters, inflation data has been trending in the right direction but very slowly so, and we may not see a major policy change until it comes all the way down to the Fed’s 2% target. Fortunately, other economic data remain more cooperative. Most importantly, GDP is still growing nicely, and we have not seen a major spike in the unemployment rate. While unemployment has ticked back up from 3.5% to 4% over the last year, each month we have more data pointing to the idea that this is more of a normalization to its long-run natural rate than a deterioration in the labor market. As a result, the economic conditions for a soft landing remain very much intact.

As November approaches, focus will turn more toward the upcoming presidential election. This will surely bring a lot of noise and distraction, but history has shown us that whoever is president is typically not a major driver of markets in a long-term way. In this particular election, despite the volatility and emotion involved, both candidates have already held the presidency and markets performed well under both administrations. If anything, the Federal Reserve’s attempts to be viewed as apolitical may lead them to avoid cutting rates during the election cycle and could defer a cut by a meeting or two, but despite the short-term noise that the election cycle is likely to bring, we do not view either result as a material event for client portfolios in the long run.

Artificial intelligence will also remain in the headlines and could continue to drive the performance of some tech names. As major investments turn into deliverable products, benefits of the technology could soon become more tangible to earnings for companies not named Nvidia. As we have already seen with the rollout of Adobe’s Firefly, Microsoft’s Copilot, and others, there is a good case for the broadening of the market from just the chipmakers to the firms that have built out early-stage AI products or can drive productivity higher through better data analysis. Non-tech sectors such as utilities (which stand to benefit from the increased power demand that AI will require), REITs (particularly Data Center REITs), and even some industrials (such as the firms that make backup generators for these data centers) are feeling the benefits as well, and the focus broadening away from being so tech-heavy should bode well for equities.

Moving forward, Condor will continue to focus on the long-term needs of our clients and prioritize quality. We will continue to seek opportunities as they present themselves, whether trimming from equity at market highs, rotating out of high-yield bonds when spreads are exceptionally tight, or buying a dip in a position we have conviction in when the market becomes overly pessimistic.