(click to enlarge)

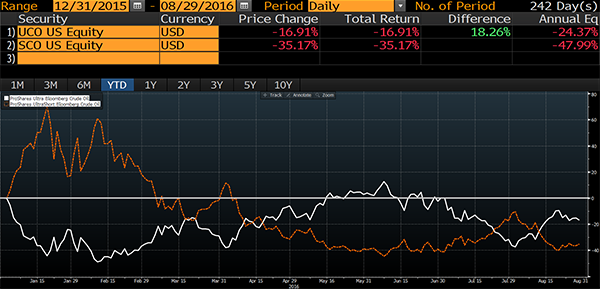

As a follow-up to our blog post from July 27, 2016 entitled The Perils of Investing In Leveraged Funds, we wanted to illustrate what has happened with two popular leveraged commodities ETFs. Specifically, we have graphed the year-to-date performance of the ProShares Ultra Bloomberg Crude Oil (UCO) ETF, which seeks daily investment results that are two times the daily return of the Bloomberg WTI Crude Oil Subindex, in white above. Additionally, in orange, is the year-to-date performance of the ProShares UltraShort Bloomberg Crude Oil (SCO) ETF, which seeks daily investment results that are two times the inverse daily return of the Bloomberg WTI Crude Oil Subindex.

Let’s say you put in months of research leading up to the start of 2016 – or just had an epiphany while getting ready for a New Year’s Eve party on December 31st, 2015 – and correctly predicted the direction of oil prices in 2016. Sitting nearly eight full months into this year, that correct prediction would not have mattered if you had used either of these leveraged oil ETFs. Why?

As illustrated above, both the ultra and ultra short oil ETFs in our example are down – significantly. The ultra (2x) option, UCO, is down nearly 17% through today’s close, while the ultra inverse (-2x) security, SCO, is down about 35%.

We said it last month and we’ll say it again: buy-and-hold investors, beware – these leveraged products are best suited for day traders.