In today’s low interest rate environment, investors have scoured the investment universe for sources of incremental income, including everything from high yield bonds, emerging market debt, and even stocks with high dividend yields. While we previously addressed the differences between high dividend stocks and bonds (see: “High Dividend Stocks are Not Bonds”), we now examine the difference between stocks with high absolute yields and those with demonstrated histories of dividend growth.

To explore this, we compare the Vanguard High Dividend Yield Index ETF (VYM) and the Vanguard Dividend Appreciation ETF (VIG). VYM is comprised of companies with the highest dividend yields, excluding real estate investment trusts, weighted by market capitalization. By contrast, VIG includes only names that have hiked their annual dividends for at least 10 consecutive years.

Portfolio Composition

The varied methods by which the indices are constructed results in some notable divergences in the ETFs’ portfolios. As illustrated in the table to the right, VIG has a materially lower stake in the Utilities sector. While such companies generally offer robust yields, the slow pace of revenue growth in this space does not allow for rapid growth in their dividend payments. On the other hand, VIG has a much higher stake in Industrials, an area with ample companies that have demonstrated histories of raising their payouts but may not have the highest absolute yields. Take industrial conglomerate United Technologies (UTX) for example, which is a top-10 holding in VIG. Although the stock yields a fairly average 1.95%, it has increased its payout every year since 1995, raising it from $0.25/share in 1995 to $2.15/share this year, a rate of nearly 12% per year.

Due to such differences, VIG sports a portfolio with average earnings, sales, and cash flow growth that are materially higher than that of VYM. At the same time, VIG’s holdings also have lower debt/capital ratios on average, resulting in a higher quality portfolio.

Returns/Risk

Evaluating the performance of both options between December 2006 and August 2013, the longest common period, VIG has delivered higher returns while simultaneously maintaining a lower standard deviation, a measure of volatility.

| Fund | Annualized Return* | Standard Deviation* (Volatility) | 5-Year Dividend Growth Rate |

| Vanguard Dividend Appreciation ETF | 5.75% | 14.45% | 7.22% |

| Vanguard High Dividend Yield Index ETF | 4.77% | 16.68% | 1.84% |

| Benchmark: SPDR S&P 500 Index ETF | 4.46% | 17.04% | 4.08% |

| *December 2006-August 2013, Source: Zephyr | |||

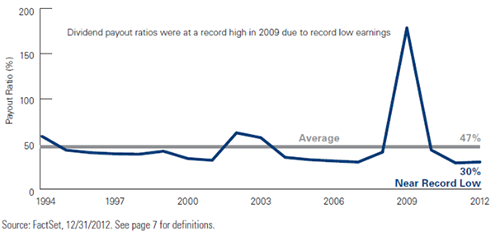

The Fundamental View

There are several fundamental considerations that bolster the appeal of names that consistently raise their dividends. In order for a business to continually increase its payout, it must be capable of generating robust and growing free cash flow. It also signifies that the companies’ management is committed to prudent capital allocation and delivering value to shareholders. In the current environment, many companies have been hesitant to reinvest profits in their businesses as economic growth has remained sluggish. Due to this, the corporate sector has become flush with cash and companies have returned a record amount of capital to shareholders through dividends and share buybacks. Despite this, dividend payout ratios are near record lows, as seen below, which should support continued dividend growth in the coming years.

Additionally, revisiting the aforementioned ETFs, VIG’s lower allocation to the Utilities and Communication Services sectors could be advantageous given that these areas have, historically, been more sensitive to rising interest rates. Against this backdrop, Condor Capital has added the Vanguard Dividend Appreciation ETF to several of its ETF models.

Dividend Payout Ratios