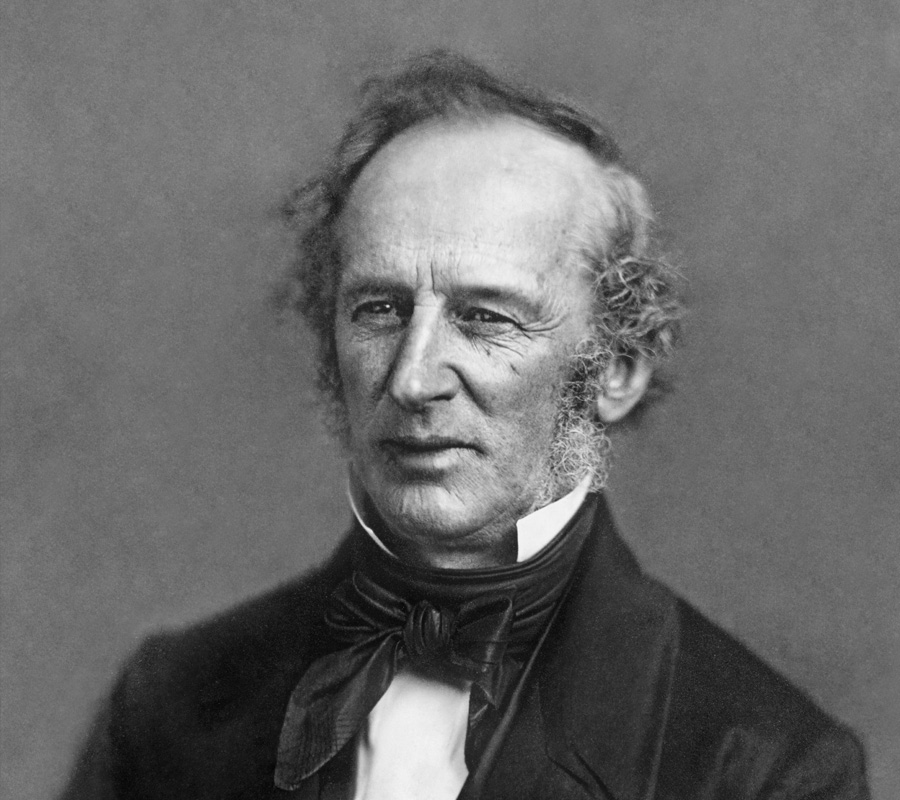

When we talk about legendary American fortunes, few names loom as large as Vanderbilt. Cornelius Vanderbilt, known as the Commodore, built one of the most extraordinary private fortunes in 19th century America. His name still endures today through institutions like Vanderbilt University, a lasting symbol of philanthropy and ambition that continues to shape education and research generations later. Through railroads and steamships, Vanderbilt amassed wealth that, when adjusted for today’s dollars, would rival the richest figures of our time.

Yet, within a few generations, that staggering fortune had almost entirely evaporated. What happened? And what can modern families and investors learn from this rise and fall?

1. Building Wealth Is Only Half the Battle

Cornelius Vanderbilt’s story is a testament to vision and execution. Rising from modest beginnings, he dominated shipping and railroad industries, leaving an estate worth over $100 million when he died in 1877 (almost $3.1 Billion in today’s dollars).

But wealth built by a singular force or business can be fragile. Vanderbilt’s heirs inherited astounding resources, but they did not inherit the same entrepreneurial discipline or strategic focus that created the fortune. Over time, lavish spending and lack of unified financial strategy weakened the foundation.

Takeaway: Accumulating wealth is essential, but the habits and structures that protect it are just as crucial.

2. Lifestyle Inflation Can Eclipse Financial Legacy

The second and third generations of Vanderbilts embraced lifestyles that rivaled royalty. Spectacular mansions like The Breakers in Newport became symbols of success, but they were also enormous ongoing expenses.

Grand estates, personal indulgences, and extravagant social expectations consumed large portions of the family’s wealth. Without a disciplined plan for sustainable spending, especially in the face of changing economic landscapes, those costs became massive liabilities that depleted the fortune.

Takeaway: Reckless spending can erode even the largest fortunes.

3. Division of Wealth Reduces Power and Influence

Vanderbilt’s estate was divided among multiple heirs, and with each division, the economic power of that share diminished. This division effect, combined with high estate taxes and limited investment diversification, fragmented the fortune.

By the mid-20th century, many iconic family estates had been sold or converted into museums due to the heirs’ rising debts. It is rumored that at a family reunion in 1973, when 120 descendants gathered, not a single attendee was a millionaire.

Takeaway: Preserving wealth across generations requires planning mechanisms, governance structures, and shared financial goals to maintain its integrity and purpose.

4. Wealth Without Financial Literacy Is Vulnerable

Many heirs lacked the financial literacy or interest to steward wealth in ways that could sustain or grow it. Without a coherent view of investment principles, risk management, and adaptation to economic change, their portion of the fortune was vulnerable.

Takeaway: Educating future generations about money is essential for maintaining generational wealth.

5. A Legacy Can Be Rewritten

While much of the Vanderbilt fortune disappeared, not every descendant faded with it. Anderson Cooper, a direct descendant of Cornelius Vanderbilt through his mother Gloria Vanderbilt, represents a different kind of legacy.

Despite being a descendant, Cooper did not inherit generational wealth. In fact, much of the remaining Vanderbilt money had already been lost by the time he came of age. Rather than relying on family resources, Cooper built his own career from the ground up, working as a freelance journalist in war zones before eventually becoming one of the most respected figures in broadcast news.

Cooper has spoken openly about how the absence of inherited wealth shaped his independence and work ethic. His success serves as a reminder that while financial capital may fade, human capital, skills, discipline, and purpose can create lasting impact.

Takeaway: Wealth can disappear, but values, education, and personal drive can still compound across generations.

Closing Thoughts

The rise and decline of the Vanderbilt fortune teaches us a fundamental truth: building wealth is hard, but preserving it over generations takes even more intention.

If you apply lessons from their experience of planning early, avoiding unchecked lifestyle inflation, investing with diversification, and equipping heirs with financial understanding, you stand a far better chance of creating a legacy that endures.