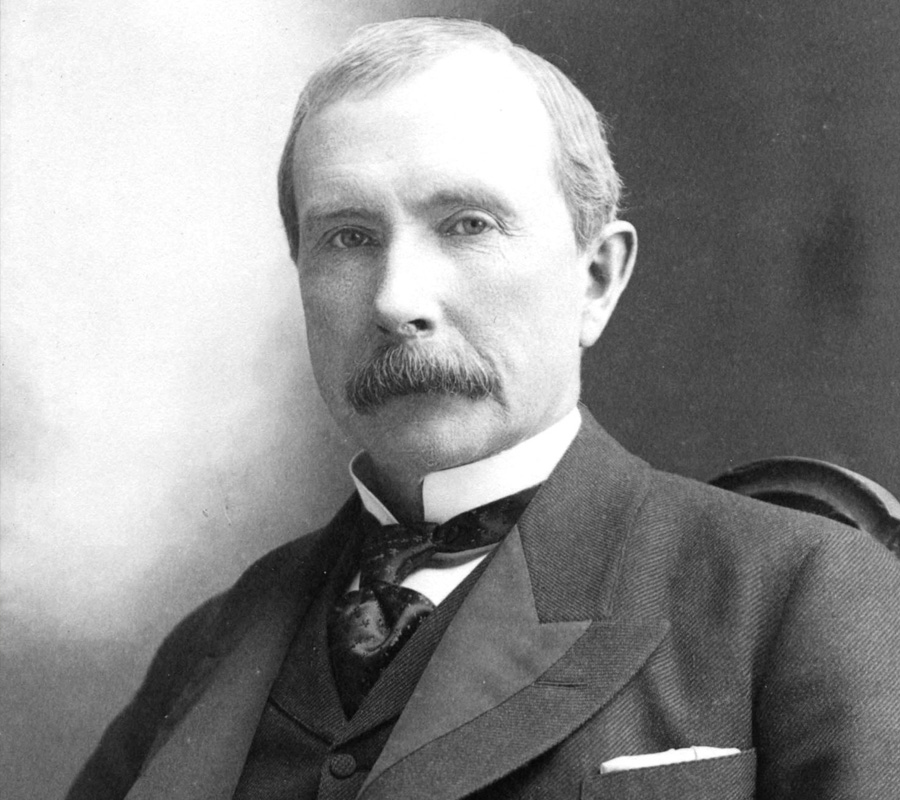

Few figures in American history embody financial discipline and long-term vision quite like John D. Rockefeller. Born in 1839 to modest means, Rockefeller built Standard Oil into one of the most powerful companies in the world and became the first American billionaire. Yet his approach to money was rooted in saving, structure, and preservation rather than excess.

Below are some of Rockefeller’s key financial lessons that still hold true today.

Lesson 1. Track Every Dollar

Rockefeller began keeping a ledger called “Ledger A” as a teenager, meticulously recording every penny he earned and spent. Even as his fortune grew, he remained committed to understanding exactly where his money went. This attention to detail laid the foundation for his business empire and his ability to make informed financial decisions.

Takeaway: Financial awareness is the first step toward financial freedom. Tracking your income and expenses, whether through an app or a simple spreadsheet, gives you clarity and control.

Lesson 2. Save Before You Spend

From his earliest paychecks, Rockefeller set aside money for both savings and charity before spending on himself. Rockefeller believed in the power of self-discipline. He famously said:

“I would rather be my own tyrant than have someone else tyrannize me.”

This mindset and savings habit drove him to maintain a strict daily routine, focus intensely on his goals, and avoid distractions. During the uncertain years of post–Civil War America, he was able to protect himself from downturns and position himself to invest when opportunities arose.

Takeaway: Build your financial resilience by prioritizing saving first. Setting aside money consistently, even in small amounts, creates flexibility to invest and weather unexpected events.

Lesson 3. Think Long Term

Rockefeller was famous for his patience. Rather than chasing short-term profits, he reinvested earnings to strengthen Standard Oil’s foundation and efficiency. His strategy paid off: while many competitors folded during oil price crashes, Rockefeller’s company emerged stronger.

Takeaway: Sustainable wealth comes from patience and long-term planning. Focus on steady growth and compounding returns instead of reacting to market noise.

Lesson 4. Diversify and Delegate

As his wealth expanded, Rockefeller diversified into industries like railroads, iron, and banking. He also built a trusted team to manage operations, understanding that success required collaboration and systems, not micromanagement.

Takeaway: Diversification and teamwork help balance risk and keep your financial goals on track. Build a team you trust to help guide you on your financial journey.

Lesson 5. Give Purposefully

Rockefeller didn’t just accumulate wealth, he used it to create lasting change. Through the Rockefeller Foundation, he funded education, medicine, and public health initiatives that continue to benefit society today. He believed giving was a responsibility tied to stewardship, not status.

Takeaway: True wealth goes beyond personal gain. Align your money with your values by giving intentionally and investing in causes that matter to you.

Closing Thoughts

John D. Rockefeller’s life demonstrates the power of discipline, strategic thinking, and a long-term perspective. His lessons are just as relevant today for anyone seeking financial independence and purpose. By applying these timeless principles, we can build lasting wealth and use it to make a meaningful difference.