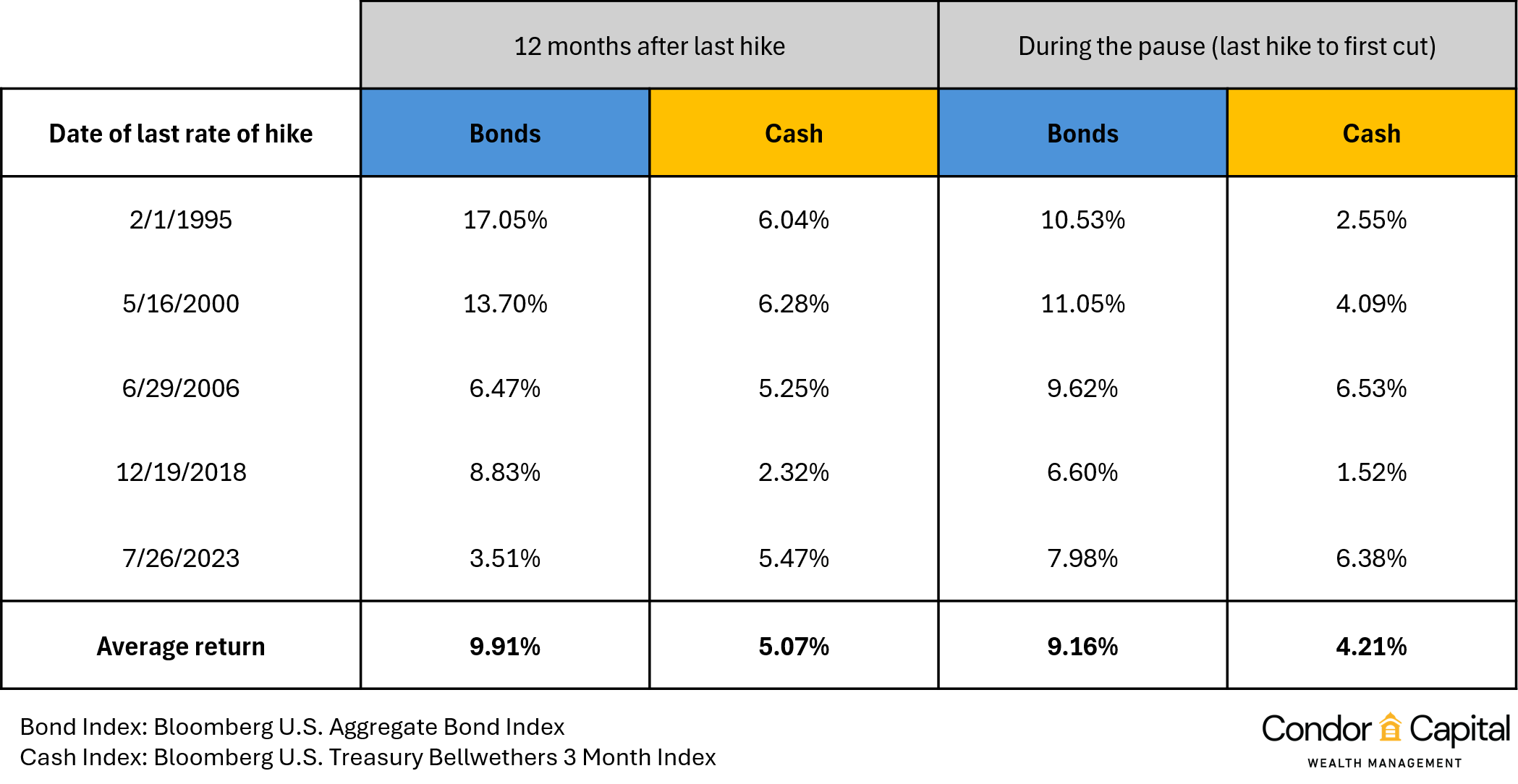

Markets now see more than an 80% chance of a rate cut from the Fed this month, and it may be a good time to reallocate short-term cash positions to medium-term fixed income positions with maturities between 5 and 10 years. From 2022 to 2024, CDs, money market funds, savings accounts, and short-term interest-bearing investments either outperformed or lagged bonds minimally. The yield from these cash positions has historically tracked the Federal Funds rate and is widely affected by monetary policy.

In contrast, longer-term bonds have an inverse relationship with interest rates, which creates a powerful dynamic for investors when the Fed is expected to cut rates. When rates fall, the price of existing bonds tends to rise, offering the potential for capital gains in addition to the bond’s yield. Conversely, holding short-term cash positions exposes you to reinvestment risk. This means that when your high-yield CD or Treasury bill matures, you will have to reinvest your principal at the new, lower market rates. By shifting from cash to bonds now, you can lock in today’s higher yields for a longer period while also positioning your portfolio to benefit from rising bond prices. If interest rates fall, the price of existing bonds tends to rise, offering the potential for capital gains.

Before the financial crisis, yields for money market funds were around 4.3-4.5%. When the Fed slashed rates by more than 5% to nearly 0%, yields on money market funds decreased to 0.9%. From 2018 to 2020, interest rates ranged from 0.25% to 2%, and annualized returns for investment-grade bonds were approximately 10%, while short-term cash positions yielded around 3.7%.

Over the last three years, however, cash has outperformed standard fixed-income strategies. The Vanguard Total Bond Market ETF, BND, had cumulative returns of approximately 3.07%, while its Federal Money Market Fund, VMFXX, had an annualized return of 3.9%. This was primarily caused by an unprecedented period of rate hikes aimed at combating rapid inflation.

As indicated in the above graph, during the last four periods of interest rate cycles, bonds on average outperformed cash by roughly 5% over the 12 months following the previous rate increase. However, during those periods, yields on 10-year Treasuries peaked even before rates were cut. During the period between peak yields and the first actual rate cut, bonds averaged returns of 9.2% compared to 4.2% returns from cash positions, meaning investors who waited to switch into long-term fixed-income positions missed out on gains.

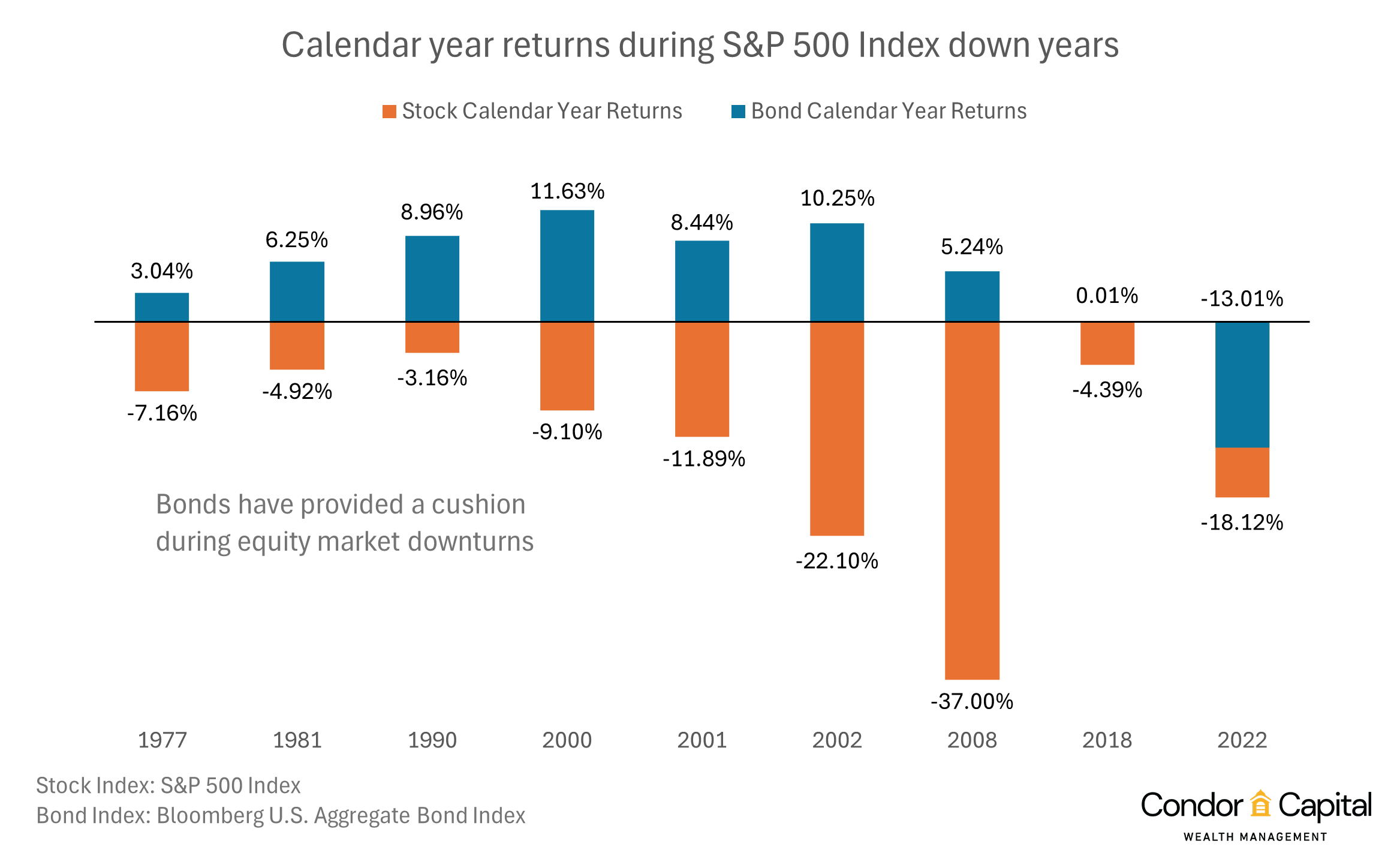

Over the last 50 years, bonds have played a significant role in offsetting total losses. There were 9 years where the S&P 500 had negative returns, and in 8 of those years, the general bond market averaged gains of 6.7% (excluding 2022).

Cash and fixed income positions both play a crucial role in diversifying your portfolio and knowing when to allocate more to one strategy can better protect you from shifts in the economy or changes to monetary policy. Cash positions have yielded returns not seen in decades, which may be coming to an end; it could be the right time to shift those positions to long-term fixed income investments.