Although robust equity returns during 2013 have certainly been welcome, one drawback for investors with taxable accounts may come next year when it comes time to file their taxes. Due to the strong equity performance, many accounts have generated capital gains over the past year. One portfolio management strategy that can reduce this burden and enhance after-tax returns is "tax loss harvesting

This strategy involves realizing capital losses, or investments that are sold below their original purchase price, which can then be used to offset capital gains. If an investor’s capital losses exceed their capital gains in that year, they can use up to $3,000 to offset their taxable income. Any unused losses can be carried over to future years, with no expiration. One important consideration to keep in mind is the so-called wash sale rule, which disallows capital loss offsets if you sell a security at a loss and then repurchase it, or a "substantially identical" security, within 30 days. To ensure that the portfolio’s allocation is not materially altered, a similar, but not "substantially identical", investment can be purchased to replicate the exposure lost due to the sale. It is important to note, however, that the IRS has been fairly ambiguous regarding its definition of "substantially identical."

The value of tax loss selling increases in relation to the investor’s tax bracket and magnitude of the loss to be recognized. It is also particularly beneficial when a capital loss can be used to offset a short-term capital gain, which is taxed at a person’s individual income tax rate, rather than the lower long-term capital gain rates.

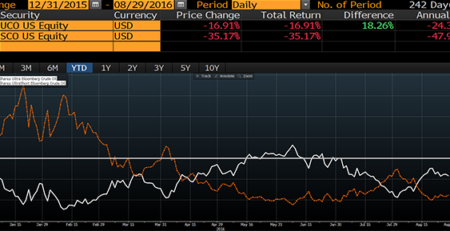

Condor Capital has already implemented this strategy in its clients’ portfolios where appropriate. With the stock market having scored since the market lows in 2009, few areas in the equity sleeve of investors’ portfolios carried losses worth harvesting. However, amid fears of rising interest rates in the U.S., some segments of the fixed income market allowed for tax loss selling. These worries particularly impacted municipal bonds and local currency emerging market debt. With that being said, we recognized losses in these areas and redeployed assets in accordance with our broader investment outlook.

It is important to remember that this technique should only be used prudently as part of a holistic, long-term investment management strategy and investors should not allow tax considerations to materially alter their broader plan. Please consult your tax professional regarding your individual tax situation.